Communication cable industry competition and development of the risk of adverse factors

时间:2019-09-18 16:28

Communication cable industry competition and development of the risk of adverse factors

1. Industry overview

At present, the communication cable industry on the whole maintained a good momentum, good market prospect has attracted a large number of foreign enterprises, they have to the joint venture in China, great changes have taken place in domestic competition pattern, gradually withdraw from state-owned enterprises, private and foreign capital enterprise vigorous development, the foreign capital enterprise for China's wire and cable manufacturing level played a role in promoting, the production, make our communication cable manufacturing technology level of narrowing the gap with foreign advanced level. But mostly due to domestic enterprises producing cheap products, low-standard market products serious supply exceeds demand, enterprise competition, relying on interacting each other, the industry still exists, low production concentration, market competition, less technology development investment, the development ability is not strong, product qualified rate is low, the product is weak overall competitiveness and profitability.

Related report: Beijing puhua youze information consulting co., LTD. "2018-2025 China telecom cable industry operation situation analysis and investment prospects feasibility study report"

From the perspective of the supply of communication cable products, at present the world communication cable industry has formed into a pattern of monopoly competition between a few big, and China's rapid economic development and huge market space and potential to attract foreign brand gradually into the communication cable industry in China, they use all sorts of advantage such as capital, technology and management, occupy the high ground of the market, participate in the domestic market by means of joint ventures or wholly owned by foreigners, contributed to the domestic industry competition; The domestic cable industry has a low concentration degree, which has many problems, such as small but complete, poor scale effect, and prominent product structural contradictions. It mainly focuses on low-end products with low profit and fierce competition. While their foreign counterparts are grabbing market share, their advanced experience in cable manufacturing, process improvement and enterprise management also provides opportunities for domestic enterprises to learn, which is beneficial to domestic cable enterprises to improve their market competitiveness.

According to the information and communication industry development plan (2016-2020) issued by the ministry of industry and information technology, China's information and communication industry revenue in 2015 was 1.7 trillion yuan, and the target revenue in 2020 was 3.5 trillion yuan, with an average annual growth rate of 15.5%. The investment in information and communication infrastructure during the 12th five-year plan period is 1.9 trillion yuan, and the investment during the 13th five-year plan period is 2 trillion yuan, which brings a huge market for China's communication cable industry.

2. Industry competition

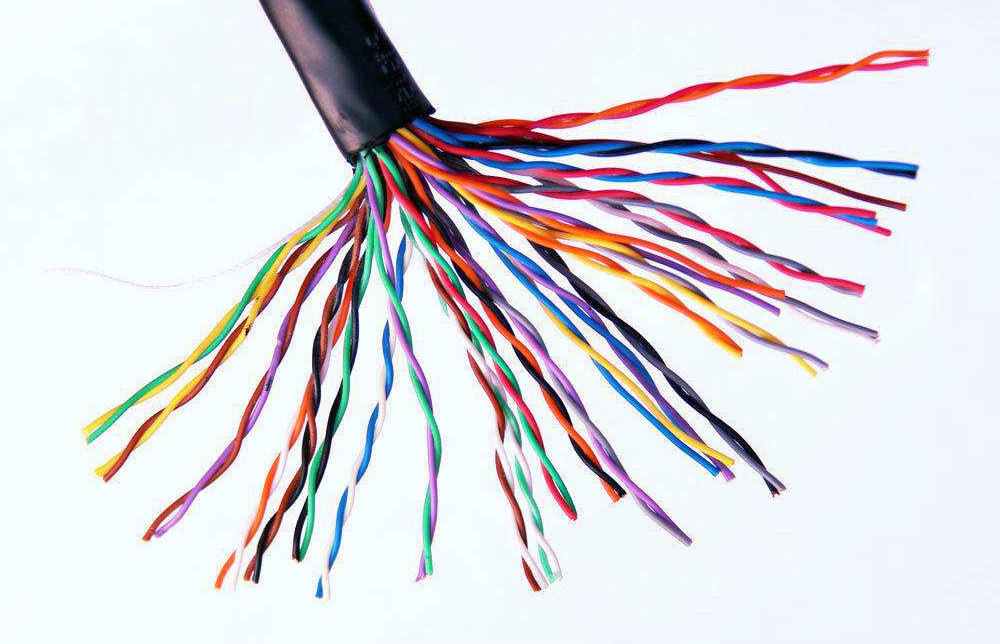

Although the wire and cable industry is only a supporting industry, it occupies 1/4 of the output value of China's electrical industry. Its product variety is numerous, application range is very extensive, involve electric power, construction, communication, manufacturing and so on industry, with each branch of national economy all close concern. Wire and cable is also known as the "artery" and "nerve" of the national economy, is the transmission of electric energy, information and manufacturing of various motors, instruments, meters, electromagnetic energy conversion indispensable basic equipment, is the future electrification, information society necessary basic products. According to the total industrial output value published by the National Bureau of Statistics, the wire and cable industry is the second largest industry in China after the automobile industry, with product variety satisfaction rate and domestic market share both exceeding 90%. In the world, China's total output value of wire and cable has surpassed that of the United States, becoming the world's largest producer of wire and cable. With the rapid development of China's wire and cable industry, the number of new enterprises is rising, and the overall technical level of the industry has been greatly improved. Communication cable is an important branch of wire and cable industry. It is widely used for its wide band and high rate multimedia transmission performance. It is mainly used in the fields of electronic communication equipment, radio frequency transmission unit of radio communication system, building wiring and CATV distribution and access network. Communication cables can be classified into single conductor, symmetrical cable and coaxial cable according to the type of cable. Among them, the output value of rf coaxial cable in China has jumped to 35% of the whole photoelectric cable industry, and has entered more than one thousand manufacturers, which is an important manufacturing industry in China. At present, the output of RF coaxial cable in China has been the first in the world, the variety specifications are complete, RF cable, CATV cable and semi-flexible cable and a large number of exports, the overall manufacturing technology has been close to the foreign advanced level. Although the cable product model is numerous, the market is huge. But in recent years, some product markets have gradually shrunk, while others have expanded rapidly.

3. Main risks and disadvantages of the industry development

(1) fierce industry competition, product structure contradictions prominent

With the continuous growth of China's economy in recent years, domestic cable television network cable, communication cable and other industries developed rapidly, the demand for wire and cable continued to grow, but the current wire and cable industry market concentration is relatively low, many manufacturers, the competition is very fierce.

(2) insufficient r&d capacity

Domestic wire and cable industry concentration is low, the capital strength of enterprises is generally not strong, research and development investment lags behind the international leading enterprises. Generally speaking, the product homogenization degree of cable industry enterprises in China is high, and they lack core competitiveness. Therefore, improving the technological innovation ability is the most urgent task in the current cable industry. Compared with foreign counterparts, China's wire and cable enterprises have a considerable gap in the investment of capital, manpower and material resources in the field of research and development, which makes it difficult for China's wire and cable industry to provide strong technical support and guarantee in carrying out basic research, changing the growth model and achieving technological breakthroughs.

(3) the price of raw materials fluctuates violently

Wire and cable industry enterprises are resource-intensive enterprises, copper, aluminum, silver and other non-ferrous metals and all kinds of plastic raw materials are the main raw materials needed by enterprises, accounting for about 90% of the production cost. Large fluctuations in raw material prices will have a greater impact on the profitability of enterprises. In recent years, the continuous decline of international commodity prices has played a positive role in promoting corporate performance to some extent. But if commodity prices rise in the future, it will lead to higher procurement prices, which will affect the cost and gross profit of the company's products. The price fluctuation of raw materials will affect the production cost of enterprises, increase the difficulty of inventory management, and make the sales price and sales revenue of products fluctuate to a certain extent.

(4) the entry of foreign-funded enterprises intensifies market competition

China's rapid economic development, strong market demand and low manufacturing costs attract foreign investment into the domestic wire and cable manufacturing industry, intensifying the industry competition. At present, the world's leading wire and cable manufacturers such as France's nexen, Italy's prysman, Japan's kohe and other enterprises have established joint ventures and sole proprietorships in China, relying on capital and technical advantages to compete with domestic enterprises for market share, further reduce the profitability of domestic enterprises.

(5) downstream market risks of products

As one of the largest supporting industries of national economy, the downstream customers of wire and cable industry are mainly power grid companies and their associated enterprises, industrial customers and general engineering users. The final use of wire and cable produced by the enterprise is mainly for domestic cable TV network cable and communication cable and other industries. Over the past few years, these industries are in growth, but as the technology upgrading and consumer spending habits change, constantly emerging companies, established businesses, and most of the downstream customers choose wire and cable has the strict certification and screening process, and wire and cable manufacturing enterprises with weak conversion product market sensitivity, seeking the difficult of rapidly changing market structure. The fluctuation and demand of the downstream industry market as well as the strategic adjustment of the enterprise management to the downstream market will directly affect the long-term business development of the enterprise in the future.

For wire and cable industry enterprises, therefore, its industry are greatly influenced by macroeconomic fluctuations, if there is a macro economic slowdown, infrastructure investment, reduce total and customers to delay purchasing plan, is a good chance to weaken the existing enterprise's profit ability, leading to the rise and fall with the downstream customers and appear different levels of performance. In addition, the wire and cable industry belongs to the asset-heavy industry, which is difficult to compress production capacity, and price competition is inevitable, so the competition situation in this industry is relatively severe.

(6) downstream product demand change risk

The end customers of wire and cable are mainly in the fields of power system, information transmission system and machine equipment and instrument system. These industries have maintained rapid growth in recent years, the capacity and output value have been greatly improved, the technical level is also constantly improving. However, with the expansion of capacity and changes in consumer demand, it is not ruled out that the growth rate of some downstream industries is slowing down or overcapacity phenomenon appears. If the phenomenon of weak demand in the downstream industry, will directly lead to the decline in the demand for wire and cable products.